How Much Can I Claim On My Taxes For Solar Panels?

As the world continues to embrace sustainable energy solutions, solar panels have become an increasingly popular choice for homeowners looking to reduce their carbon footprint and energy bills. Not only do solar photovoltaics (PV) help you save on your electricity costs, but they can also provide a significant tax benefit thanks to the US federal ‘Residential Clean Energy Credit’. In this article, we’ll explore how much you can claim on your taxes for solar PV panels, helping consumers maximize your solar savings and positively impact the environment. This article blow covers a comprehensive guide, but the quick guide is here: how solar panel tax credits work.

The Federal Investment Tax Credit (ITC) – The Basics

Solar energy has become an increasingly popular choice for homeowners seeking to reduce their carbon footprint and energy costs. One of the key incentives driving this adoption is the Federal Investment Tax Credit (ITC). This means you can claim a portion of tax for installing solar panels?

What is the significance of the ITC for the solar sector?

The Federal Investment Tax Credit (ITC) is a critical financial incentive for individuals and businesses looking to invest in solar panel installations. This credit was established as part of the Energy Policy Act of 2005, to encourage the adoption of renewable energy sources, thereby reducing the nation’s reliance on fossil fuels and mitigating the environmental impact of energy consumption.

It plays a pivotal role in significantly reducing the upfront costs associated with the installation of solar panels, making them a more accessible and economically viable option for homeowners and businesses alike.

What is the rate set at?

At its inception, the ITC provided a 30% tax credit, coupled with a 2,000 dollar cap for residential projects. Nevertheless, the year 2008 marked a pivotal moment when the cap was eliminated, ushering in enhanced financial benefits for residential solar installations with increased capacity.

In August 2022, President Joe Biden signed the Inflation Reduction Act, extending the availability of solar tax credits until 2034. Officially named the ‘Residential Clean Energy Credit’, this program encompasses various expenses, including equipment and installation costs, while excluding structural alterations solely intended for panel support.

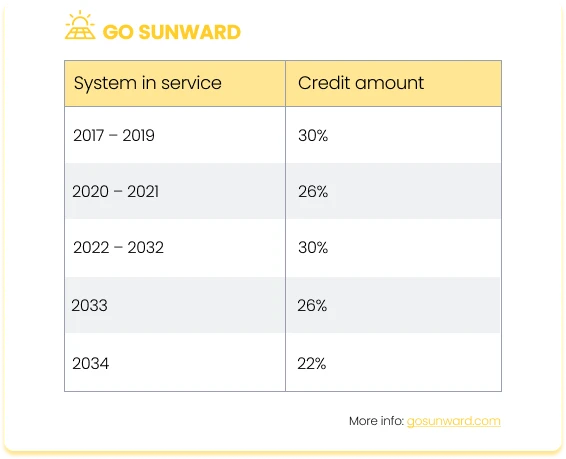

The actual amount accessible as solar tax credits may fluctuate, contingent upon your project expenditures and completion date. Nevertheless, these solar incentives remain accessible to homeowners who put a qualifying system into service anytime between 2017 and 2034, thanks to the recent extension.

For the tax year 2023 (to be filed in 2024), the solar panel tax credit stands at a consistent rate of 30% of eligible expenses. This 30% credit will persist from the tax year 2023 all the way through 2032.

How much can I claim on my taxes for solar panels?

The solar tax credit is a valuable nonrefundable credit equivalent to 30% of your solar project’s gross system cost. For example, if your solar project’s total cost is $20,000, the tax credit would amount to $6,000 ($20,000 x 30% = $6,000).

It’s crucial to understand that the solar tax credit is not a direct payment but rather a credit that can reduce your federal income tax liability. This reduction can either increase your tax refund or lower the amount you owe in taxes.

For instance, if your solar system is deemed operational by a city inspector in 2023, you can claim a $6,000 tax credit when filing your 2023 federal income tax return, due in 2024. If your tax liability surpasses $6,000, you can claim the entire credit in a single year. However, if your tax liability is less than $6,000, you have the option to carry forward the remaining credit to offset taxes in future years.

You can also estimate your solar savings using this free calculator.

What are the key benefits of the ITC?

The solar panel tax credit offers several key benefits to solar panel owners:

- Substantial Savings: The ITC can result in substantial savings, reducing the overall cost of your solar panel installation.

- Reduced Payback Period: With the ITC, the payback period for your solar panel investment becomes shorter, allowing you to recoup your initial costs more quickly.

- Increased Return on Investment (ROI): By lowering your expenses, the ITC enhances the ROI of your solar panel system, making it a financially attractive long-term investment.

- Environmental Impact: Investing in solar panels with the assistance of the ITC contributes to a cleaner environment by reducing carbon emissions and reliance on fossil fuels.

The ITC is a pivotal incentive for solar panel owners, making clean and sustainable energy more accessible and financially advantageous. Understanding its eligibility requirements, credit percentage, and potential monetary value is essential for anyone considering a solar panel installation.

Looking Beyond The ITC

Besides the federal tax credit, there are other ways to claim tax benefits for solar energy systems. These can vary depending on your location and specific circumstances.

For example, many states and local governments offer their own solar incentives, such as tax credits, rebates, or performance-based incentives. These can significantly reduce the cost of your solar installation.

Some states also have Solar Renewable Energy Certificates (SRECs), that are programs that allow you to earn and sell SRECs based on the amount of solar energy your system generates. This can provide additional income or savings.

In addition, certain areas offer property tax exemptions or reductions for properties with solar installations. This can help you save on your property taxes. Meanwhile, net metering and Feed-In Tariff programs allow you to earn credits or payments for excess electricity your solar panels generate and feed back into the grid. It effectively reduces your electricity bill or provides an income stream.

In some cases, you may be eligible for grants or low-interest loans to help finance your solar project, which can indirectly reduce your tax burden by lowering the overall cost.

If you install solar panels for a business, you may be eligible for various tax incentives and deductions specific to commercial solar installations. Businesses can also often depreciate the cost of solar equipment over time, reducing their taxable income.

Example of stacking incentives:

To demonstrate the potential for significant cost savings, let’s consider a solar project with a total gross system cost of $20,000. Initially, you would qualify for a federal tax credit of $6,000, which is equivalent to 30% of the project’s cost.

Now, let’s envision that California offers a state rebate of $2,000 for your solar installation. By applying this rebate, your total expenses are reduced to $18,000.

Furthermore, your local municipality has a solar incentive program in place, providing an additional $1,000 in savings to support your project.

If your utility company supports net metering, you have the opportunity to maximize long-term savings by selling any excess solar-generated power back to the grid. These cumulative incentives can significantly enhance the affordability and financial benefits of your solar investment.

Taking the Next Steps: Leveraging Solar Tax Savings

Here’s a comprehensive step-by-step roadmap of exactly how you claim on taxes for solar panels:

Step 1: Confirm Eligibility – Before you begin the process, it’s crucial to verify that you meet all the eligibility criteria for the federal solar tax credit. This involves confirming the presence of a qualifying solar installation and ensuring you have adequate tax liability.

Step 2: IRS Form 5695 – The foundation of your solar tax credit claim is IRS Form 5695, officially titled “Residential Energy Credits.” This form must be completed to determine the precise credit amount you qualify for. Within the form, you’ll find sections dedicated to various residential energy credits, including the solar tax credit.

Step 3: Assemble Supporting Documents – Gather all the necessary documentation required to substantiate your claim. This may encompass invoices, receipts, and evidence of payment related to your solar system installation. Proper documentation is vital to validate your expenses and facilitate a successful claim.

Step 4: Comprehensive Form Completion – Diligently fill out IRS Form 5695, ensuring accuracy in all calculations and entries. Follow the provided instructions and provide specific details regarding your solar project.

Step 5: Submit Your Tax Return – When you file your federal income tax return (e.g., Form 1040 or Form 1040NR), include the completed IRS Form 5695. Be sure to meet the annual tax filing deadline, which is typically April 15th, unless an extension applies.Step 6: Reduce Tax Liability – The solar tax credit directly lowers your federal income tax liability. If the credit amount surpasses your tax liability, it can result in a tax refund or offset future tax obligations.

How To Maximize Your Tax Benefits

When installing solar panels, it’s essential to grasp the nuances of maximizing tax benefits to optimize your return on investment and answer the pivotal question: ‘How much can I claim for solar panels on my taxes?’

We have collated some top tips on how to maximize your tax benefit when Installing solar panels:

Top Tip #1: Plan Your Installation Timing – Be strategic about when you install your solar panels. The ITC percentage can change from year to year and it is important to monitor changes and policy alterations carefully.

Top Tip #2: Optimize System Size – Consider the size and capacity of your solar panel system. A larger system can potentially yield more energy and greater tax benefits.

Top Tip #3: Utilize Available State Incentives – Research and take advantage of state and local incentives in addition to federal benefits.

Top Tip #4: Combine with Other Energy-Efficient Upgrades – Consider bundling solar panel installations with other energy-efficient upgrades to maximize tax credits and incentives. Click here for ideas on how to save money on electricity.

Top Tip #5: Consult Tax Professionals – Seek guidance from a tax professional or accountant who specializes in renewable energy tax credits. They can help you navigate complex tax laws and ensure you’re claiming all available credits.

Top Tip #6: Keep Detailed Records – Accurate record-keeping is essential for claiming your tax benefits effectively. Maintain detailed records of your solar panel expenses, including receipts and invoices, documentation of state and local incentives, loan and financing documents and energy production data. By keeping thorough records, you ensure you have the necessary documentation to support your claims and potentially avoid any issues during a tax audit.

Hiring A Professional Tax Advisor Or Accountant To Help You Claim On Your Taxes For Solar Panels?

Given the complexity and ever-changing nature of tax laws related to solar panel installations, it is often recommended that you hire a professional tax advisor or accountant to guide you through the residential solar energy process.

Specialization in the field of renewable energy and green tax incentives is crucial when it comes to optimizing the tax benefits associated with solar panel installations. Tax advisors and accountants who have honed their expertise in this domain possess the knowledge and experience necessary to help you make the most of available incentives and credits. Their specialized understanding allows them to provide tailored advice that caters to your specific circumstances, ensuring you don’t miss out on potential savings.

Moreover, these professionals play a pivotal role in strategic planning for your solar panel project. They can carefully consider factors like tax credit percentages, the timing of your installation, and your eligibility for various incentives. This strategic approach not only maximizes your financial benefits but also ensures that your solar panel investment aligns optimally with your long-term financial goals.

Furthermore, tax experts bring efficiency to the table. They can streamline the process, assisting you in completing the necessary paperwork accurately and within deadlines. This reduces the risk of errors and delays, making the entire process smoother and more hassle-free. Additionally, their expertise extends to audit support, which can be invaluable in the event of an audit. Having a tax professional by your side provides peace of mind, as they can help you navigate the audit process and supply the necessary documentation to substantiate your claims, ultimately safeguarding your investment.

Conclusion

If you’re wondering about the tax benefits of solar panels and asking, “How much can I claim on my taxes for solar panels?” it’s important to recognize the substantial potential for savings. The Federal Investment Tax Credit (ITC) and various state and local incentives exist to assist in mitigating the costs associated with transitioning to clean energy.

To make the most of these opportunities, conducting thorough research and gaining a solid understanding of local incentives are vital steps. Staying well-informed about state rebates, local tax credits, and performance-based incentives can result in substantial financial advantages. Furthermore, meticulous record-keeping, including keeping track of invoices, receipts, and payment records for your solar system, is essential to substantiate your claims when it comes time to file your taxes.