Do You Get A Tax Refund From Solar Tax Credit?

Solar panel tax credits stand as a major incentive in the journey toward a more sustainable energy landscape in the United States. They provide financial help for homeowners and businesses looking to harness the power of solar energy while simultaneously reaping the rewards of reduced carbon emissions and lower electricity bills. For those embarking on the path to renewable energy, the prospect of financial incentives is a significant driving force. Among the questions that often arise is whether taxpayers can anticipate a tax refund as a result of utilizing the solar tax credit. In this article, we delve into the intricacies of the solar tax credit, exploring its potential impact on your financial landscape and addressing the common question: ‘Do you get a tax refund from solar tax credit?’

Solar Panel Tax Credits: The Background

To promote the widespread adoption of solar energy, the United States government offers tax credits for solar systems, with the Federal Solar Investment Tax Credit (ITC) serving as a pivotal incentive. Established as part of the Energy Policy Act of 2005, the ITC has a strong history of driving the growth of renewable energy. Its primary purpose is to provide financial support to individuals and businesses opting for solar power systems.

The ITC has played a transformative role in making solar energy more accessible and economically viable for homeowners and corporations across the country. This incentive offers a substantial tax credit, allowing eligible taxpayers to offset a significant portion of the expenses related to solar system installations. This financial boost acts as a catalyst for transitioning to clean energy, reducing the financial barriers for those considering solar power.

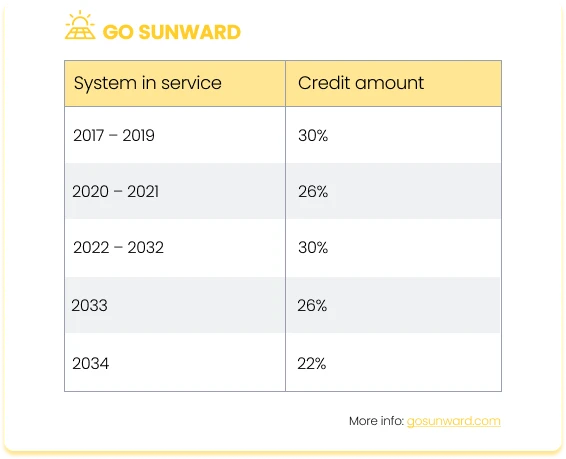

Initially, the ITC provided a 30% tax credit with a $2,000 cap for residential projects. However, a significant milestone was reached in 2008 when the cap was eliminated, enhancing the financial benefits for residential solar installations with increased capacity. Since its inception, the ITC has undergone various revisions, extensions, and rate adjustments.

Understanding this history and recent developments surrounding the ITC is essential for individuals and businesses contemplating solar installations, as it offers insights into the tax credit’s evolution and the current favorable conditions for solar investment.

Where Do We Stand With The ITC Now?

In August 2022, President Joe Biden signed the Inflation Reduction Act, extending the availability of federal tax credits for solar until 2034. Officially known as the residential clean energy tax credit, this program covers various expenses, including equipment and installation costs, while excluding structural alterations solely intended for panel support. Moreover, the solar tax credit can, in some cases, be combined with state incentives and utility-backed initiatives that promote clean energy adoption.

The actual amount you can receive as solar tax credits may vary, depending on your project costs and completion date. However, these solar incentives remain accessible to homeowners who put a qualifying system into service anytime between 2017 and 2034, thanks to the recent extension.

For the tax year 2023 (to be filed in 2024), the solar panel tax credit remains at a consistent rate of 30% of eligible expenses. This 30% credit will persist from the tax year 2023 through 2032.

The Benefits Of The Solar Panel Tax Credit

The benefits of receiving a solar tax credit refund are numerous and can greatly enhance the financial feasibility of installing solar panels.

- Financial Savings: Solar tax credits provide a direct reduction in your federal income taxes owed. This means that you can deduct a percentage of the cost of your solar panel system from your tax liability. By utilizing this credit, you can potentially save thousands of dollars on your tax bill.

- Lower Installation Costs: The availability of a solar tax credit often makes solar panel installation more affordable. This helps offset the initial investment required for purchasing and installing the solar system, making it a more viable option for many homeowners and businesses.

- Increased Return on Investment (ROI): With a solar tax credit, the payback period for your solar investment is significantly reduced. This means that you can recoup your initial costs through energy savings and other financial incentives more quickly. In turn, this leads to a higher return on investment over the lifespan of your solar panels.

- Environmental Benefits: By installing solar panels, you are contributing to the reduction of greenhouse gas emissions and the promotion of clean, renewable energy. Receiving a tax credit refund further incentivizes this eco-conscious decision by making it financially rewarding. You can take pride in knowing that your solar installation is helping to combat climate change and protect the environment.

- Energy Independence: Solar panels empower you to generate electricity, reducing dependence on conventional energy sources and utility providers. With solar power, you gain control over your energy production, ensuring a reliable and self-sustaining source of electricity for your needs. This autonomy in energy generation enhances your ability to maintain power even during grid disruptions, strengthening your energy independence and self-reliance.

How Does The Solar Panel Tax Credit Work? Common FAQs:

How is the solar tax credit calculated? The solar tax credit is calculated at 30% of your eligible expenses for solar energy equipment. In practical terms, if you’ve spent $20,000 on a solar system installation, you can claim a tax credit of $6,000 (30% of $20,000) when filing your federal income tax return.

How do you claim the credit when filing taxes? To claim the solar tax credit, you’ll need to complete IRS Form 5695, titled “Residential Energy Credits.” This form allows you to determine the precise credit amount based on the expenses related to your solar project. After completing Form 5695, attach it to your federal income tax return, such as Form 1040 or Form 1040NR.

Do you get a tax refund from solar tax credit? It’s crucial to distinguish between a tax credit and a tax refund when it comes to the solar tax credit. This credit is nonrefundable, meaning it can directly reduce your federal income tax liability, essentially lowering the amount you owe in taxes. However, if the credit exceeds your tax liability for the year, any excess credit won’t be refunded. Instead, you can carry forward the unused portion of the credit as a tax deduction from future tax obligations, as long as the credit remains available. See the below section for more detailed insights into whether you get a tax refund from the solar tax credit.

Is there an income limit on the tax credit? It’s important to note that there are no income limits on the solar tax credit, making it accessible to all individual taxpayers who invest in qualifying solar energy equipment for their homes within the United States. However, if you enter into a lease agreement or power purchase agreement for solar-generated power, you won’t be eligible to claim the credit as the system owner.

How long does it take for my solar tax credit refund to be processed? The processing time for your solar tax credit refund is subject to various factors. Typically, it can take anywhere from a few weeks to a few months after you’ve submitted your claim.

However, this timeframe is not fixed and can be influenced by several variables. One key factor is the workload of the Internal Revenue Service (IRS), especially during peak tax seasons, which can lead to longer processing times due to a high volume of tax returns and refund requests. Additionally, the accuracy and completeness of your claim play a vital role; any errors or missing information can result in delays. Thus, it’s essential to review all necessary documents and details before submission to prevent processing setbacks. Lastly, changes in tax laws or regulations may also affect processing times as the IRS adjusts its systems and processes to comply with recent revisions to the solar tax credit.

The Potential For A Tax Refund: The Key Takeaways

Many taxpayers wonder whether they can receive a tax refund through the solar tax credit for their solar PV system. Here’s what you need to know:

1. Non-Refundable Tax Credit: The solar tax credit, officially known as the Residential Clean Energy Credit, is a non-refundable tax credit. This means that it can offset your federal income tax liability dollar-for-dollar, reducing the amount you owe in taxes. However, it doesn’t operate as a direct payment or cash refund.

2. Tax Liability Offset: When you have sufficient tax liability, the solar tax credit can significantly reduce or entirely offset the amount you owe in federal income taxes. In such cases, it effectively lowers your tax bill.

3. Unused Credit Rollover: If the solar tax credit amount exceeds your tax liability for the tax year in which you claimed it, the excess credit won’t be refunded to you as cash. Instead, you have the option to “roll over” the unused portion of the credit to future tax years. This rollover can continue as long as the credit remains available.

4. Understanding Your Tax Situation: It’s essential to comprehend your tax situation and calculate your tax liability accurately. By doing so, you can maximize the benefits of the solar tax credit. Consult with a tax professional or use tax preparation software to ensure accuracy and compliance with tax regulations

Qualifying For The Solar Tax Credit

To qualify for the solar tax credit, you must meet specific criteria:

Eligible Equipment: The Residential Clean Energy Credit covers qualified energy-saving equipment, which includes:

- Solar-powered equipment for electricity generation or water heating.

- Solar power storage equipment, starting in 2022. A minimum capacity of 3 kilowatt hours (kWh) is required from 2023 onwards.

- Qualifying installation and labor costs.

Exclusions: The tax credit does not apply to systems that are leased or used solely for heating swimming pools or hot tubs.

Qualified Homes: To be eligible for the solar credit, energy-saving improvements must be made to your US residence. This can include various types of homes, such as houses, houseboats, mobile homes, cooperative apartments, condominiums, and manufactured homes conforming to Federal Manufactured Home Construction and Safety Standards.

Eligibility Criteria: To claim the solar tax credit, you must meet these conditions:

- The solar equipment must have been installed between January 1, 2017, and December 31, 2034.

- The solar equipment must be located at a residence in the United States.

- The solar equipment should either be new or used for the first time, meeting the original installation requirement for claiming the credit.

Ownership or Participation: To claim the credit, you must satisfy one of the following conditions:

- Purchase the solar photovoltaic system using cash or financing methods other than a lease or an agreement to pay a solar company for generated electricity.

- Invest in a community solar project separate from your residential property, where the electricity generated is credited against your home’s consumption and doesn’t exceed it.

Meeting these criteria is essential for determining your eligibility to claim the solar tax credit when filing your tax return.

Conclusion

The solar tax credit, officially known as the Residential Clean Energy Credit, offers a pathway to potential financial benefits while promoting sustainability. While the solar tax credit doesn’t result in an immediate tax refund, it can lead to substantial savings by reducing your overall tax liability. Understanding the nuances of this credit and its impact on your taxes is crucial for making the most of this financial incentive for solar energy adoption.

As we move towards a low-carbon and sustainable future, we encourage you to explore solar energy options and leverage the solar tax credit. Making the most of the credit requires understanding its details and ensuring your solar project aligns with eligibility criteria. By doing so, you can harness the power of the sun while enjoying potential tax savings.