How Does The Federal Tax Credit Work For Solar?

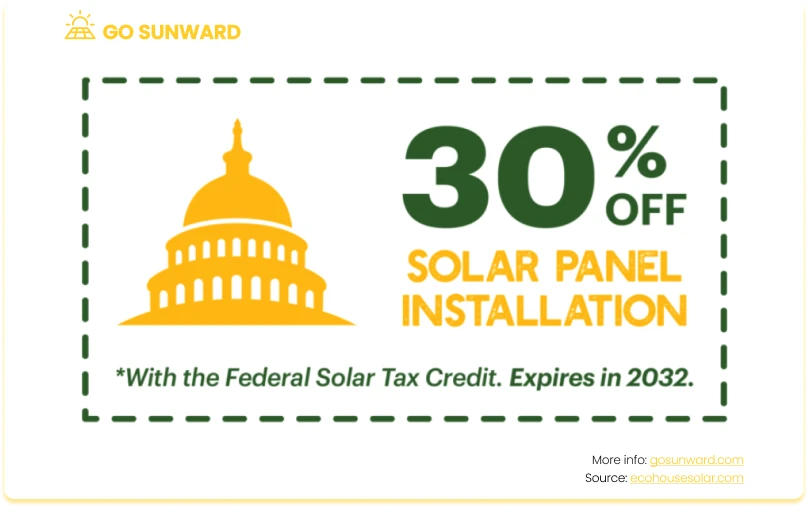

The federal solar tax credit is an unparalleled economic incentive that makes investing in solar panels and battery storage in the US an incredibly cost-effective choice for homeowners. By completing some additional paperwork during tax season, you can effectively recoup 30% of your total solar system cost, without any upper limit. In this article, we will delve into the intricacies of the federal tax credit for solar, comprehensively answering the question: How Does The Federal Tax Credit Work For Solar? We will explore what this tax credit entails, who can benefit from it, and how it can translate into significant savings for homeowners and businesses alike. Furthermore, we will highlight upcoming changes and deadlines, and guide you through the application process. By the end of this article, you will have a thorough understanding of how the federal tax credit for solar works and how it can empower you to embrace clean and renewable energy while reducing your carbon footprint and energy costs.

What is the Federal Solar Tax Credit?

The Federal Solar Investment Tax Credit (ITC) is a critical incentive designed to encourage the adoption of solar energy in the United States. Established as part of the Energy Policy Act of 2005, the ITC has a rich history of promoting renewable energy growth. Its primary function is to provide financial relief to individuals and businesses who invest in solar power systems.

The ITC has been instrumental in making solar energy more accessible and affordable for homeowners and companies nationwide. It offers a substantial tax credit, allowing qualified taxpayers to offset a significant portion of their solar system’s installation cost. This financial incentive is a powerful driver in the transition to clean energy, reducing the barriers to entry for those considering solar energy adoption.

At its inception, the ITC offered a 30% tax credit, with a cap of $2,000 for residential projects. However, the cap was lifted in 2008, opening the door to more significant financial benefits for homeowners.

Since its inception, the ITC has experienced multiple revisions, extensions, and rate adjustments. In 2022, the tax credit was temporarily reduced to 26%. However, in August 2022, President Joe Biden signed the Inflation Reduction Act, extending the availability of solar tax credits until 2034. It was officially named the residential clean energy tax credit. This effectively restored the credit to its original 30 percentage rate. Notably, this 30% rate is set to remain in effect through 2032, providing a long-term incentive for solar energy adoption.

Understanding this history and the recent developments surrounding the ITC is vital for those considering solar installations, as it sheds light on the tax credit’s evolution and the current favourable conditions for solar investment.

How Does The Federal Tax Credit Work For Solar?

The solar tax credit is a valuable nonrefundable credit equivalent to 30% of your solar project’s gross system cost. To illustrate, if your solar project’s total cost is $20,000, the tax credit would amount to $6,000 ($20,000 x 30% = $6,000).

It’s crucial to understand that the solar tax credit is not a direct payment but rather a credit that can reduce your federal income tax liability. This reduction can either increase your tax refund or lower the amount you owe in taxes.

For instance, if your solar system is deemed operational by a city inspector in 2023, you can claim a $6,000 tax credit when filing your 2023 federal income tax return, due in 2024. If your tax liability surpasses $6,000, you can claim the entire credit in a single year. However, if your tax liability is less than $6,000, you have the option to carry forward the remaining credit to offset taxes in future years.

What Is Covered Under The Solar Tax Credit?

As outlined by Energy.gov, the solar tax credit encompasses the following components within the gross system cost:

- Solar panels

- Inverters

- Balance-of-system equipment, which includes racks and conduit

- Installation labor

- Permitting fees

- Inspection costs

- Other soft costs

- Sales tax

- Energy storage devices (commonly known as batteries), whether they are physically integrated into the solar system or not (as of January 1, 2023).

It’s important to note that while the solar tax credit covers a broad range of expenses associated with solar installations, it does not extend to cover roofing expenses unless the roof itself is an integral part of the solar equipment.

Additionally, electrical panel or wiring upgrades are not included in the solar tax credit; however, separate incentives for these upgrades are available.

What About Other Renewable Energy Projects?

The residential clean energy credit extends its coverage to various other types of renewable energy projects embarked upon by homeowners, including:

- Solar electric installations.

- Solar water heaters.

- Small wind energy projects.

- Biomass fuel systems.

- Fuel cell projects.

- Geothermal heat pumps.

What About Local State Incentives?

It is possible to take advantage of both the federal solar tax credit and solar incentives offered by your state, local government, or utility provider. This can maximize the financial benefits of your solar investment.

State and Local Incentives: Let’s consider the case of California, a state known for its robust solar incentives. In addition to the federal tax credit, California offers the California Solar Initiative (CSI) rebate program, which provides substantial financial incentives for solar installations. Suppose you decide to take advantage of both the federal tax credit and the CSI rebate.

Claiming Local Incentives First: To optimize your savings, it is a good idea to claim the local incentives first. For instance, the CSI program may offer a rebate of $2,000 for your solar system. By applying this rebate to your $20,000 system cost, your net expenditure decreases to $18,000.

Federal Tax Credit Application: After reducing the overall cost with local incentives, you can then claim the federal solar tax credit. In this scenario, the federal tax credit of 30% would apply to the lesser amount of $18,000. This means you would claim a $5,400 federal tax credit on your taxes ($18,000 x 30% = $5,400).

By strategically combining federal, state, and local incentives, you can significantly reduce the upfront costs of your solar installation, making solar energy adoption even more financially attractive.

Claiming the Tax Credit: A Step-by-Step Guide

Understanding how to claim the federal tax credit for solar is crucial to maximize your savings and ensure a smooth process. Here, we provide a comprehensive step-by-step guide to help you navigate the claiming process effectively:

Step 1: Eligibility Check: Before you begin the claiming process, ensure that you meet all eligibility criteria for the federal solar tax credit. This includes having a qualifying solar installation and sufficient tax liability.

Step 2: IRS Form 5695:The cornerstone of claiming the solar tax credit is IRS Form 5695, officially titled “Residential Energy Credits.” You will need to fill out this form to calculate the exact credit amount you are eligible for. The form includes sections for various residential energy credits, including the solar tax credit.

Step 3: Gather Documentation: Collect all necessary documentation to support your claim. This may include invoices, receipts, and proof of payment related to your solar system installation. Proper documentation is essential to substantiate your expenses and ensure a successful claim.

Step 4: Complete IRS Form 5695: Carefully complete IRS Form 5695, ensuring accuracy in all calculations and entries. Be sure to follow the instructions provided with the form, and don’t forget to include the specific details of your solar project.

Step 5: File Your Tax Return: When filing your federal income tax return (e.g., Form 1040 or Form 1040NR), attach the completed IRS Form 5695. Make sure to file your taxes by the annual deadline, typically April 15th, unless an extension applies.

Step 6: Reduce Tax Liability: The solar tax credit directly reduces your federal income tax liability. If the credit amount is greater than your tax liability, it can lead to a tax refund or offset future tax obligations.

Top Tip: Consult With Tax Professionals: While the process of claiming the solar tax credit is straightforward, it’s advisable to consult a tax professional or accountant to ensure accuracy and compliance with tax regulations. Tax professionals can provide expert guidance, helping you maximize your eligible credit while avoiding potential errors.

Policy Risks & Legislative Changes

In the realm of renewable energy incentives, such as the Investment Tax Credit (ITC), changes in legislative and government policies can have a negative impact on the sector. Here are some key points to remember:

Government Policy Impact

- Government policies and tax laws can significantly impact the availability and extent of incentives like the ITC. These policies are subject to change based on evolving priorities and political decisions.

- Changes in administration or shifts in political dynamics can lead to alterations in energy and environmental policies. For instance, a government that prioritizes renewable energy and climate action may be more inclined to extend or enhance solar incentives.

Potential Revisions, Extensions, or Expirations

- Tax incentives, including the ITC, are not set in stone. They can be revised, extended, or allowed to expire based on legislative decisions.

- The ITC itself has witnessed several extensions and adjustments in its history, which have had a significant impact on solar adoption rates. For example, the credit was initially set to expire but has been extended multiple times to stimulate the growth of solar energy.

Informed Decision-Making

- Staying informed about legislative developments is paramount for individuals and businesses considering solar investments. Awareness of potential changes in tax incentives can influence the timing and scale of solar projects.

- Proactively engaging with industry organizations, renewable energy advocates, and your representatives can help you keep track of legislative developments.

Conclusion

The federal solar tax credit stands as a pivotal catalyst in promoting the widespread adoption of renewable energy, particularly solar power, in the US. As we have explored throughout this article, understanding how the federal tax credit works for solar is paramount for those seeking sustainable and cost-effective energy solutions.

Here are some key takeaways:

- The solar tax credit offers substantial financial benefits, allowing you to recoup a significant portion of your solar system’s cost.

- It can be combined with other solar incentives from your state, local government, or utility provider, further enhancing your savings.

- Timely planning and installation are crucial to maximize the current 30% credit rate before it gradually reduces in the coming years.

- Keeping a watchful eye on legislative developments is essential, as government policies and tax laws can influence the availability and extent of the ITC.

As we look toward a more sustainable future, we encourage you to explore solar energy options and leverage the ITC to embark on your journey toward a low-carbon, more cost-effective, and environmentally sustainable way of living. Once you’re ready to get started, check if your roof will work for solar.