Solar Tax Rebates: How Solar Tax Credits Work Per State

Solar energy has gained remarkable traction as a clean and sustainable power source in recent years. As our world grapples with the pressing challenges of climate change and environmental degradation, the shift towards renewable energy solutions like solar power has become imperative. Amidst this transition, one crucial factor stands out as a beacon of financial relief for homeowners and businesses alike: solar tax rebates. These incentives play a pivotal role in making solar energy not just a responsible ecological choice but also an economically attractive one.

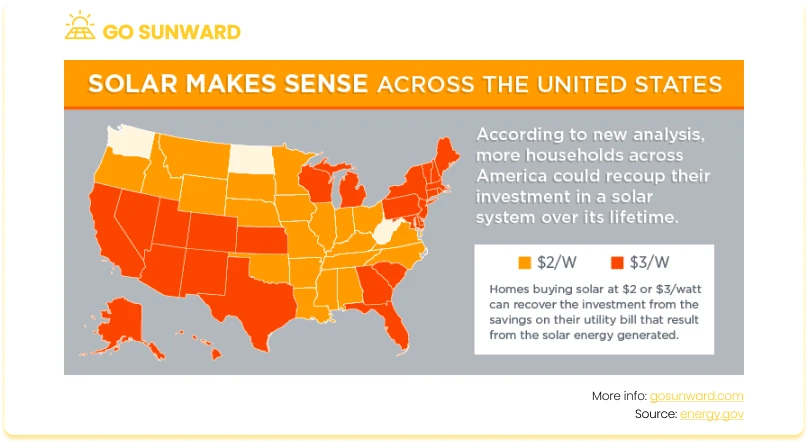

Across the United States, the landscape of solar tax credits and solar tax rebates is as diverse as the geography itself. Each state boasts its own set of incentives, creating a patchwork quilt of opportunities for individuals and organizations seeking to harness solar energy. From sunny California to the northeastern states and beyond, these state-specific incentives can significantly impact the affordability and feasibility of solar installations.

As we embark on this journey through the world of solar tax rebates, we’ll delve into the intricacies of how these credits work, explore the unique offerings of different US states, and uncover the financial benefits that await those who choose to embrace solar energy.

Understanding Solar Tax Rebates

Solar tax credits are a crucial component of incentivizing the adoption of solar energy in the US. In this section, we’ll delve into the fundamental concepts behind these credits, including their definition, purpose, distinctions from deductions, and the financial advantages they offer to both homeowners and businesses.

Solar Tax Credits 101

Solar tax credits, often referred to as solar investment tax credits (ITC) in the US, are government-sponsored financial incentives designed to promote the installation and use of solar energy systems.

They exist primarily to achieve several important goals:

- Promote Renewable Energy: Solar tax credits encourage the transition to clean and sustainable energy sources by reducing the financial barriers associated with solar system installation.

- Reduce Greenhouse Gas Emissions: By supporting solar adoption, these credits contribute to the reduction of greenhouse gas emissions, making a significant impact on mitigating climate change.

- Fostering Economic Growth: Solar energy incentives stimulate economic growth by creating jobs in the renewable energy sector, attracting investments, and promoting innovation in clean energy technologies.

Solar tax credits differ from other forms of financial incentives, such as a tax deduction or tax refund. Tax credits, including solar tax credits, directly reduce the amount of taxes you owe on your annual tax return. They provide a dollar-for-dollar reduction in your tax liability, effectively lowering your tax bill. Deductions, on the other hand, reduce your taxable income, which indirectly affects your tax liability. Tax credits are typically more advantageous than deductions, as they provide a more substantial reduction in taxes.

Solar tax credits offer substantial financial benefits to both homeowners and businesses:

- Cost Reduction: By claiming solar tax credits, homeowners and businesses can significantly reduce the upfront costs of solar system installation, making solar energy more affordable and accessible.

- Return on Investment: Solar tax credits accelerate the return on investment (ROI) for solar projects, allowing individuals and organizations to recoup their initial investment more quickly through energy savings and tax benefits.

- Long-Term Savings: Solar systems generate clean and sustainable electricity, resulting in long-term energy savings. The combination of reduced energy bills and tax credits makes solar energy a financially advantageous choice.

Federal Tax Credit: A Recap

Before diving into the intricacies of state-specific solar tax rebates, let’s take a moment to review the federal-level solar incentive in the US.

The Federal Investment Tax Credit (ITC) is a crucial federal-level program supporting solar energy adoption in the US by reducing financial barriers to buying solar panels. It offers a dollar-for-dollar reduction in federal income tax liability.

This percentage-based benefit allows eligible solar system owners to claim a tax credit equal to a portion of their system’s cost. Recent extensions, including the 2022 Inflation Reduction Act, have extended the availability of solar tax credits until 2034 under the ‘Residential Clean Energy Credit’ program.

For the 2023 tax year (to be filed in 2024), the solar panel tax credit remains at a consistent rate of 30% of eligible expenses, continuing at this level until 2032. This extension provides homeowners with ample opportunity to benefit from solar incentives.

For more detailed information on the federal solar tax credit, click here.

State-Specific Solar Tax Rebates

While federal solar tax credits provide a robust foundation for solar energy adoption, state-specific incentives are pivotal in making solar photovoltaics even more appealing.

State-level incentives complement ITC by tailoring solar support to the specific needs and goals of individual states.

These incentives are crucial for many reasons:

Customization: State incentives can be customized to address regional energy challenges, environmental concerns, and economic objectives. This targeted approach ensures that solar incentives align with local priorities.

Additional Savings: State-level incentives provide additional financial relief, making solar installations more cost-effective. By combining federal and state credits, homeowners and businesses can maximize their savings.

Promoting Solar Growth: State governments have a vested interest in promoting solar adoption to meet renewable energy targets and reduce carbon emissions. State-specific incentives encourage residents and businesses to invest in solar energy, furthering these objectives.

State Variations: Key Examples

State-specific solar tax rebates can vary significantly from one state to another. These variations encompass eligibility criteria, credit amounts, and the types of solar projects that qualify.

Some states offer performance-based incentives, while others focus on upfront cost reductions or cash rebates. Here are some key examples:

- California: Under the California Solar Initiative (CSI), residents and businesses can benefit from cash rebates for installing solar photovoltaic (PV) systems. The rebates are performance-based, meaning that the amount received depends on factors like system size, location, and expected energy production. This encourages the efficient use of solar technology and maximizes incentives for solar adopters.

- New York: New York’s NY-Sun Solar Program promotes solar energy adoption by providing incentives based on project size, location, and energy production. This performance-based approach encourages homeowners and businesses to maximize their solar investments.

- Texas: Texas offers property tax exemptions for the added value of solar installations, ensuring that property taxes do not increase due to solar investments. This helps reduce the financial burden for solar adopters in the state

- Arizona: The Arizona Residential Solar Energy Credit provides homeowners with a credit of up to $1,000 for solar water heating systems, reducing the cost of transitioning to solar energy and making domestic heating improvements.

- Massachusetts: The Residential Renewable Energy Income Tax Credit provides Massachusetts homeowners with a state tax credit worth up to 15% of the cost of their solar system. The state tax credit maxes out at $1,000.

- Colorado: Colorado offers a state income tax credit of up to 5% of the cost of a solar energy system installation, with a maximum credit of $1,000 for residential systems. This credit helps homeowners offset the expenses associated with going solar.

- North Carolina: North Carolina provides a 35% state tax credit for solar energy systems, making it an attractive destination for solar investments. The credit applies to both residential and commercial solar installations and contributes significantly to lowering the overall cost.

- Hawaii: Hawaii’s Renewable Energy Technologies Income Tax Credit offers a substantial credit of up to 35% for solar installations, with a maximum credit limit. This generous incentive is in line with the state’s commitment to achieving renewable energy goals.

- New Jersey: New Jersey offers a state-based Solar Renewable Energy Certificate (SREC) program. This program allows solar system owners to earn and sell SRECs, providing a financial incentive based on the amount of solar energy generated. It effectively transforms solar energy into a marketable commodity.

- Maryland: Maryland’s Residential Clean Energy Grant Program offers financial incentives to homeowners who install solar energy systems. These incentives, combined with the federal tax credit, make solar installations more affordable and attractive for Maryland residents.

- Minnesota: Minnesota’s Solar-Electric (PV) System Credit provides a tax credit for homeowners and businesses that install solar PV systems. The credit is based on the system’s capacity and helps offset the initial investment costs.

By exploring these state-specific examples and understanding the nuances of solar tax credits in different regions, homeowners and businesses can make informed decisions about harnessing the power of solar energy while benefiting from state-level incentives tailored to their specific circumstances.

Researching Your State’s Solar Tax Rebates

Understanding and accessing state-specific solar tax credits is a critical step towards maximizing your solar savings.

1. Official State Government Websites

One of the most reliable sources for information on state-specific solar tax credits is your state’s official government website.

- Department of Energy or Environment: Visit the state’s Department of Energy or Department of Environment website. They often provide comprehensive information about renewable energy incentives, including solar tax credits.

- Taxation or Revenue Department: Check the website of your state’s taxation or revenue department. Information regarding tax credits and incentives is typically available in the tax section.

- Renewable Energy Programs: Some states have specific programs or agencies dedicated to renewable energy. Explore these sections for details on solar incentives and how to apply for them.

2. Online Databases & Tools

Several online databases and tools are designed to help you quickly access information on solar incentives specific to your state

- DSIRE Database: The Database of State Incentives for Renewables & Efficiency (DSIRE) is a comprehensive resource that provides information on renewable energy incentives, including solar tax credits, for all U.S. states. You can search by state to find relevant programs and incentives.

- Solar Calculator Tools: Some websites offer solar calculator tools that not only estimate your potential savings but also provide information on state incentives. These tools can help you assess the financial benefits of going solar. For more information on solar calculators, click here.

3. Local Energy Agencies & Professionals

Local energy agencies and professionals are valuable sources of information for understanding the intricacies of solar incentives in your area.

- Contact Local Energy Agencies: Contact your state’s energy or environmental agencies. They often have experts who can provide guidance and answer specific questions about solar tax credits in your region.

- Consult Solar Installers: Local solar installation companies are well-versed in the state’s incentive programs. They can explain how incentives work, assist with the application process, and provide estimates of potential savings.

4. Stay Informed and Verify Information

State-level incentives may change over time, so it’s crucial to stay informed and verify information. Check for updates and revisions to incentive programs on a regular basis, especially if you’re planning a solar installation in the future.

Conclusion

Solar tax rebates are pivotal in the transition to cleaner, more sustainable energy sources. They serve as catalysts for change by making solar energy not just an environmentally responsible choice but also a financially advantageous one. By reducing the financial barriers associated with solar installations, these credits empower individuals and businesses to embrace solar power.

State-specific solar tax credits add a layer of customization to the solar adoption journey. They tailor incentives to address regional energy needs, environmental concerns, and economic priorities. This personalized approach ensures that residents and businesses can maximize their solar investments while supporting local energy objectives. The combination of federal and state incentives opens doors to substantial savings, accelerating the return on investment for solar projects.

We encourage our readers to explore the potential savings and environmental benefits of going solar. By taking advantage of available solar tax credits, you not only improve your financial outlook but also contribute to a cleaner and more sustainable world. Solar energy reduces carbon emissions, lessens dependence on fossil fuels, and fosters a more sustainable global energy system.